What Makes Carbon DeFi Unique?

Carbon DeFi distinguishes itself from existing automated market makers (AMMs) in several key ways:

Adjustable Fee: Users who provide liquidity ("makers") can set a specific buy range and a specific sell range for their tokens, which establishes a custom fee/spread, instead of all makers having to adopt the fee that is prescribed by the AMM.

Rotating Liquidity: Liquidity is automatically moved between the maker's selected buy/sell ranges as orders are executed.

Irreversible Orders: User liquidity trades in one direction, irreversibly.

MEV Resistance: Spot trading is protected from MEV sandwich attacks.

Adjustable Fee

Users who create strategies in Carbon DeFi ("makers") are similar to liquidity providers in existing AMMs in that their activities supply liquidity for trading, and they collect fees from other users ("takers") who perform spot trades using their liquidity.

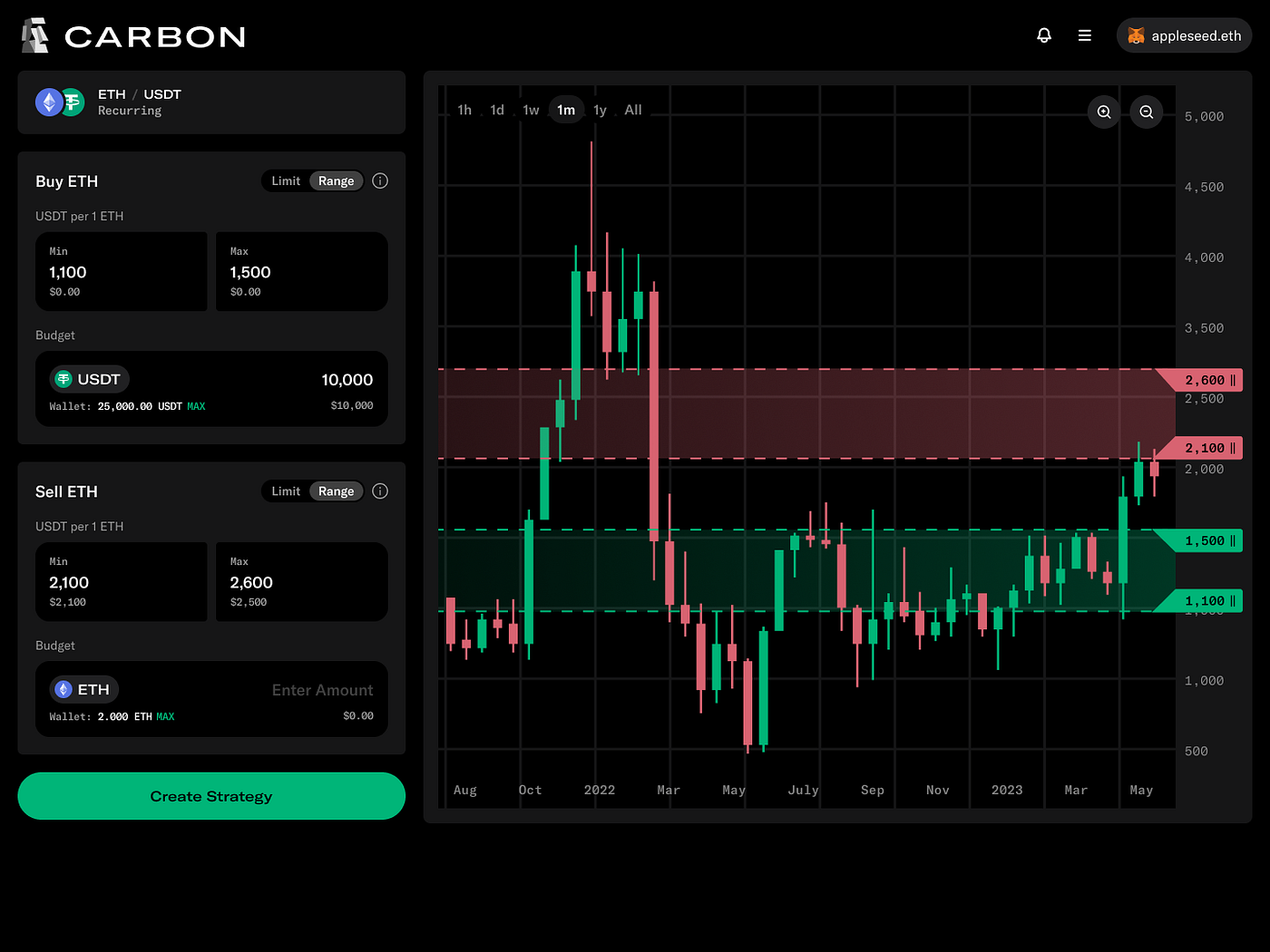

However, Carbon DeFi is unique in that each individual maker can customize the fee they collect from trades - i.e., the difference between their selected buy and sell ranges. While legacy AMMs force their liquidity providers to adopt the fee of the AMM they're providing liquidity to, Carbon DeFi lets LPs set their own personalized fee (or spread) by selecting the specific price(s) where they'd like to buy and sell their tokens.

Rotating Liquidity

When a user provides liquidity in existing on-chain liquidity protocols/AMMs, their position buys and sells tokens using a single pricing curve ("bonding curve").

In Carbon DeFi, each user position consists of two bonding curves (or "orders") - one for buying and one for selling. When a user deposits a token pair, each token in the pair has one custom curve based on settings decided by the user. Once your position buys or sells at your desired price, your liquidity is automatically rotated to its paired curve, and vice versa.

In the case of a single-use limit or range order on Carbon DeFi, as the order is executed, liquidity is taken "off-curve" and shifted to an inactive paired order, where it sits idle until the maker withdraws their position.

In the case of a recurring strategy, buy and sell orders trade in perpetuity, and liquidity continuously shifts between the paired orders as trades are executed, until the user chooses to stop the strategy. Such a strategy offers to buy in one price range and sell in a higher range akin to a "Grid Trading" or "Scalping" strategy.

Unidirectional, Irreversible Orders

In existing concentrated liquidity protocols like Uniswap V3, executed orders may be reversed when markets retrace. This is due the bidirectional nature of AMM liquidity: Once a buy order for one asset is traded against, a sell order for the other asset is placed at the same price. To avoid order reversal, users must manually monitor and withdraw their liquidity upon execution (or rely on external tooling to do so).

In contrast, limit/range orders in Carbon DeFi flow in a single direction and are therefore irreversible on execution. This removes the need for users to constantly monitor their orders and manually withdraw in time, or rely on a third-party to do so. Read more about Carbon DeFi limit orders.

MEV Protection

Due to the irreversibility of Carbon DeFi orders, spot trades that execute against Carbon DeFi strategies are protected from MEV sandwich attacks. Read more about Carbon DeFi and MEV.

Last updated

Was this helpful?